Bank Account Application: Make sure the odds are on your side

Understanding banks

A bank is not a public service but a commercial business that needs to balance risk and gain, in order to be successful. A bank must not be expected to carry costs and risks for the benefit of its clients. Taking this into account, banks expect a mutually beneficial relationship that compensates clients onboarding costs. Applicants must be willing to meet the commitments taken in terms of minimum deposit and any other fees that are required, this will vary depending on the jurisdiction and choice of bank. It also means the bank will want to obtain sufficient guarantees that the purpose of applying for an account is for legal and legitimate purposes. It is the client’s responsibility to take a bank’s expectations into account when applying for accounts.

Follow expert advice

SFM and its agents relay precise bank requirements which derive from bank policies and regulations. It is crucial that the indications provided are followed and individuals do not take it upon themselves to deviate from them. Applicants should address all the requirements and seek further guidance to gain clarification on any questions they may have to ensure understanding and compliance. Deviating away from expert advice and avoiding policies and regulations will result in delay and increased costs as well as an unsuccessful application.

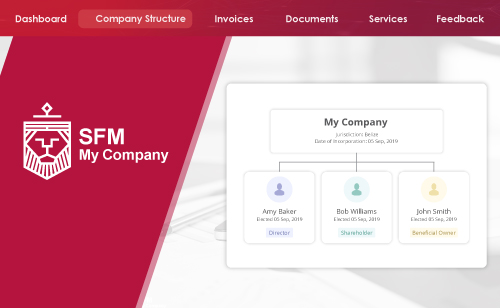

Our professional status as "International Corporate Service Provider" and our signing of a good conduct charter makes us a welcomed introducer in the eyes of financial establishments in general. We have developed a banking network and expertise which enables us to assist our clients through the account application for all companies we register. Obviously, the final decision to open an account lies with the bank.

What documents are needed?

General documents which are requested include a certified copy of the shareholder’s and director’s passport (beneficial owner), as well as proof of residence which must be less than three months old. The full scope of documents will vary from bank to bank. In some jurisdiction’s banks do not allow accounts to be opened by correspondence, meaning clients will need to go into the bank in order to verify identity. Additional documents that banks might require could be a summarized business plan, a letter of reference issued by an attorney or a bank, financial statements, a a curriculum vitae,evidence of the origin of net wealth.

The importance of your application

Any bank needs to know their client and their business, which is done by collecting official documentation and information provided by the client. Creating a first impression with your chosen bank is of upmost importance and we encourage you to always be forthcoming with any requested information to avoid delays. Precise, comprehensive and correct information must be provided at all times and false information is prohibited. Questions from your bank of choice must be met with clear and factual answers. Eluding questions, dismissive or partial responses and false information will all result in unsuccessful applications.

For more information regarding bank account opening in any of our jurisdictions contact SFM.

Disclaimer:

- Each bank account application is subject to the bank’s mandatory due diligence requirements and duties under national and international (FATF) standards, in particular to prevent money laundering, and nothing on this webpage shall be construed as an offer to waive such requirements and duties.

- Banks are listed on our website as example only. You will need to confirm your choice of a bank after the registration of your company. You have no obligation to select a listed bank and may propose another bank of your choice. SFM is not proposing bank services. An introduction service includes the preparation of the application form and the submission of the application file. Any application is subject to the acceptance of the client by the bank.

Share this news on: